How To Compute Operating Income Using The Traditional Costing System 13+ Pages Explanation [1.8mb] - Latest Revision

40+ pages how to compute operating income using the traditional costing system 3mb answer in Doc format . Product 540X 152900 Product 137Y 121000 Product 249S 46100 Using the following formula compute the percentage difference in operating income for each of the product lines of Ayala. The traditional costing system is best used when an organization has low overhead costs compared to the direct production costs they pay. Therefore the calculation of AC is as follows Absorption cost Formula Direct labor cost per unit Direct material cost per unit Variable manufacturing overhead cost per unit Fixed manufacturing overhead per unit. Read also compute and how to compute operating income using the traditional costing system Operating Income ABC ating traditional cost operating Income traditional cost.

Dont buy Deals Shop for Best Price How To Compute Operating Income Using Traditional Costing System Compare Price and Options of How To Compute Operating Income Using Traditional Costing System from variety stores in usa. Round answers to 2 decimal places eg.

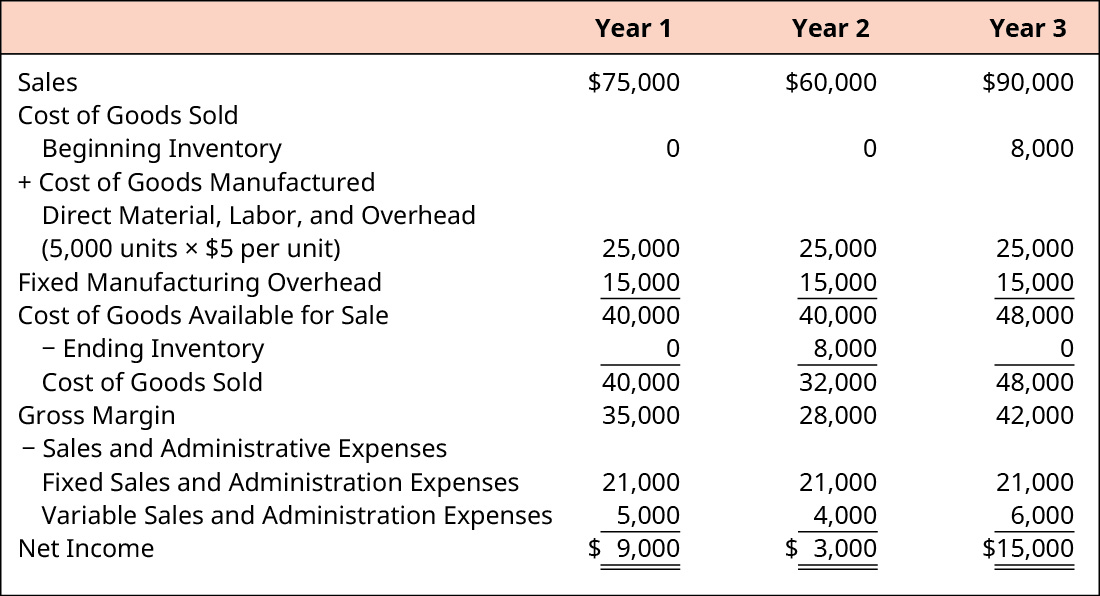

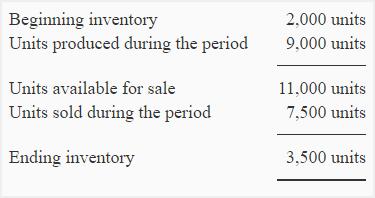

The Traditional Ine Statement Absorption Costing Ine Statement Format Examples Accounting In Focus

| Title: The Traditional Ine Statement Absorption Costing Ine Statement Format Examples Accounting In Focus How To Compute Operating Income Using The Traditional Costing System |

| Format: PDF |

| Number of Views: 7181+ times |

| Number of Pages: 342+ pages about How To Compute Operating Income Using The Traditional Costing System |

| Publication Date: March 2020 |

| Document Size: 1.3mb |

| Read The Traditional Ine Statement Absorption Costing Ine Statement Format Examples Accounting In Focus |

|

PDF How To Compute Operating Income Using Traditional Costing System BY How To Compute Operating Income Using Traditional Costing System.

The trouble with traditional costing is that factory overhead may be much higher than the. Both the traditional and the activity-based costing systems include direct materials and direct labor costs. Round the percentage to two. A For each product line Compute Operating Income using the Traditional Costing System. Product 249 S. For each product line compute operating income using the activity-based costing system.

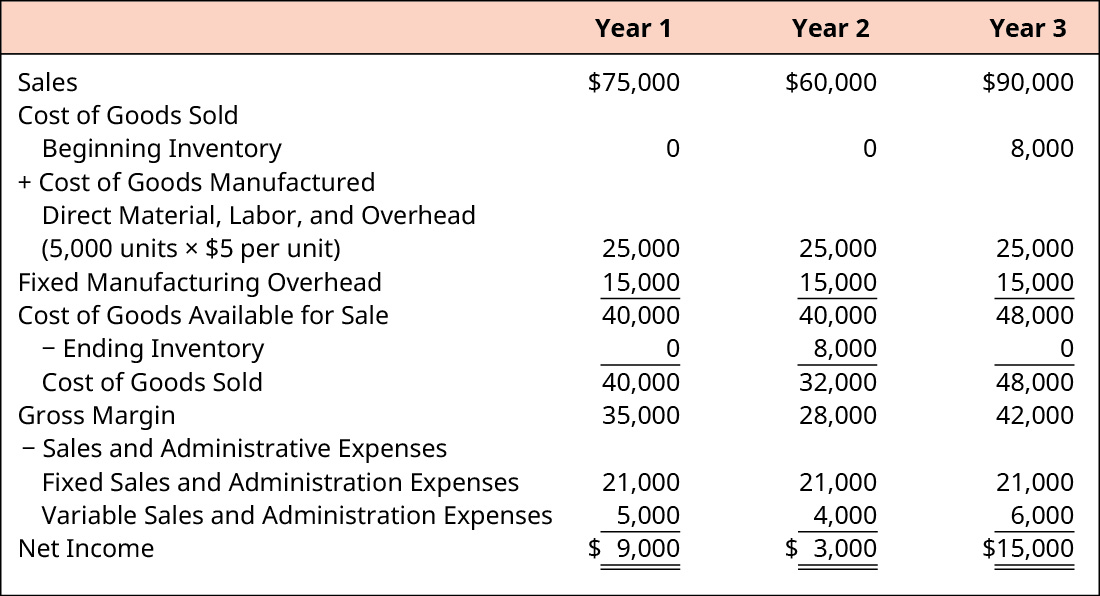

Causes Of Difference In Operating Ine Under Variable And Absorption Costing Accounting For Management

| Title: Causes Of Difference In Operating Ine Under Variable And Absorption Costing Accounting For Management How To Compute Operating Income Using The Traditional Costing System |

| Format: PDF |

| Number of Views: 3320+ times |

| Number of Pages: 162+ pages about How To Compute Operating Income Using The Traditional Costing System |

| Publication Date: February 2020 |

| Document Size: 6mb |

| Read Causes Of Difference In Operating Ine Under Variable And Absorption Costing Accounting For Management |

|

Causes Of Difference In Operating Ine Under Variable And Absorption Costing Accounting For Management

| Title: Causes Of Difference In Operating Ine Under Variable And Absorption Costing Accounting For Management How To Compute Operating Income Using The Traditional Costing System |

| Format: Doc |

| Number of Views: 3360+ times |

| Number of Pages: 55+ pages about How To Compute Operating Income Using The Traditional Costing System |

| Publication Date: January 2020 |

| Document Size: 3.4mb |

| Read Causes Of Difference In Operating Ine Under Variable And Absorption Costing Accounting For Management |

|

How Do Operating Ine And Revenue Differ

| Title: How Do Operating Ine And Revenue Differ How To Compute Operating Income Using The Traditional Costing System |

| Format: Doc |

| Number of Views: 7187+ times |

| Number of Pages: 345+ pages about How To Compute Operating Income Using The Traditional Costing System |

| Publication Date: September 2021 |

| Document Size: 1.2mb |

| Read How Do Operating Ine And Revenue Differ |

|

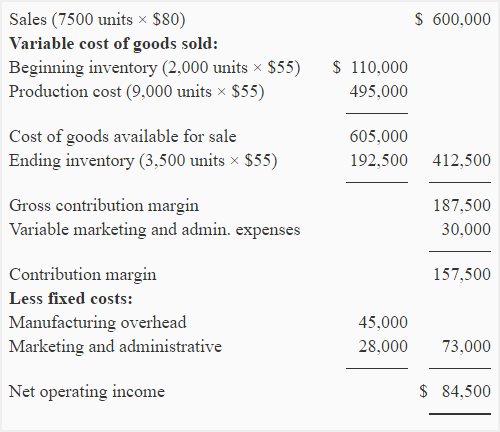

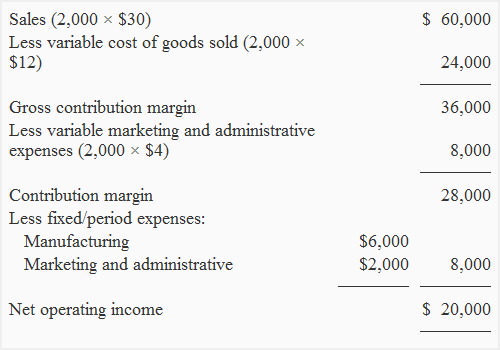

Contribution Margin Ine Statement Accounting For Management

| Title: Contribution Margin Ine Statement Accounting For Management How To Compute Operating Income Using The Traditional Costing System |

| Format: Google Sheet |

| Number of Views: 8180+ times |

| Number of Pages: 80+ pages about How To Compute Operating Income Using The Traditional Costing System |

| Publication Date: March 2021 |

| Document Size: 1.7mb |

| Read Contribution Margin Ine Statement Accounting For Management |

|

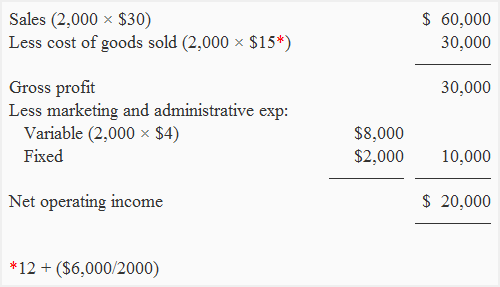

Ine Statements Under Marginal Variable And Absorption Costing Statement To Reconcile Profits Format Solved Examples

| Title: Ine Statements Under Marginal Variable And Absorption Costing Statement To Reconcile Profits Format Solved Examples How To Compute Operating Income Using The Traditional Costing System |

| Format: Google Sheet |

| Number of Views: 9154+ times |

| Number of Pages: 142+ pages about How To Compute Operating Income Using The Traditional Costing System |

| Publication Date: October 2017 |

| Document Size: 2.6mb |

| Read Ine Statements Under Marginal Variable And Absorption Costing Statement To Reconcile Profits Format Solved Examples |

|

Causes Of Difference In Operating Ine Under Variable And Absorption Costing Accounting For Management

| Title: Causes Of Difference In Operating Ine Under Variable And Absorption Costing Accounting For Management How To Compute Operating Income Using The Traditional Costing System |

| Format: PDF |

| Number of Views: 3030+ times |

| Number of Pages: 270+ pages about How To Compute Operating Income Using The Traditional Costing System |

| Publication Date: July 2018 |

| Document Size: 2.1mb |

| Read Causes Of Difference In Operating Ine Under Variable And Absorption Costing Accounting For Management |

|

Causes Of Difference In Operating Ine Under Variable And Absorption Costing Accounting For Management

| Title: Causes Of Difference In Operating Ine Under Variable And Absorption Costing Accounting For Management How To Compute Operating Income Using The Traditional Costing System |

| Format: PDF |

| Number of Views: 5151+ times |

| Number of Pages: 132+ pages about How To Compute Operating Income Using The Traditional Costing System |

| Publication Date: December 2018 |

| Document Size: 1.9mb |

| Read Causes Of Difference In Operating Ine Under Variable And Absorption Costing Accounting For Management |

|

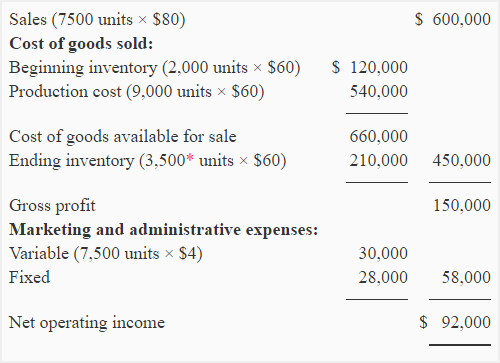

Pare And Contrast Variable And Absorption Costing Principles Of Accounting Volume 2 Managerial Accounting

| Title: Pare And Contrast Variable And Absorption Costing Principles Of Accounting Volume 2 Managerial Accounting How To Compute Operating Income Using The Traditional Costing System |

| Format: Google Sheet |

| Number of Views: 9206+ times |

| Number of Pages: 95+ pages about How To Compute Operating Income Using The Traditional Costing System |

| Publication Date: February 2020 |

| Document Size: 3.4mb |

| Read Pare And Contrast Variable And Absorption Costing Principles Of Accounting Volume 2 Managerial Accounting |

|

Genevieve Wood I Picked This Diagram Because Of The Side Side View Of The Contribution Ma Contribution Margin Ine Statement Similarities And Differences

| Title: Genevieve Wood I Picked This Diagram Because Of The Side Side View Of The Contribution Ma Contribution Margin Ine Statement Similarities And Differences How To Compute Operating Income Using The Traditional Costing System |

| Format: Google Sheet |

| Number of Views: 3166+ times |

| Number of Pages: 208+ pages about How To Compute Operating Income Using The Traditional Costing System |

| Publication Date: February 2018 |

| Document Size: 1.3mb |

| Read Genevieve Wood I Picked This Diagram Because Of The Side Side View Of The Contribution Ma Contribution Margin Ine Statement Similarities And Differences |

|

Contribution Margin Ine Statement Accounting For Management

| Title: Contribution Margin Ine Statement Accounting For Management How To Compute Operating Income Using The Traditional Costing System |

| Format: Doc |

| Number of Views: 3340+ times |

| Number of Pages: 213+ pages about How To Compute Operating Income Using The Traditional Costing System |

| Publication Date: March 2019 |

| Document Size: 3.4mb |

| Read Contribution Margin Ine Statement Accounting For Management |

|

Absorption Costing Formula Calculation Of Absorption Costing

| Title: Absorption Costing Formula Calculation Of Absorption Costing How To Compute Operating Income Using The Traditional Costing System |

| Format: Google Sheet |

| Number of Views: 8168+ times |

| Number of Pages: 216+ pages about How To Compute Operating Income Using The Traditional Costing System |

| Publication Date: November 2021 |

| Document Size: 2.1mb |

| Read Absorption Costing Formula Calculation Of Absorption Costing |

|

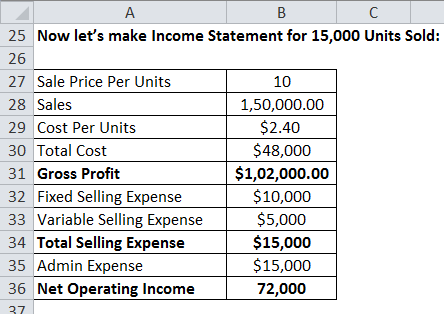

Job 1 Job 2 Labor Hours 2 6 Overhead Allocation 30 90 Overhead Rate 120 8 direct labor hours Overhead Rate 15 per direct labor hour Job 1 2 hours 15 per hour 30 Job 2 6 hours 15 per hour 90 Traditional Costing Systems 5. A For each product line Compute Operating Income using the Traditional Costing System. Product 249 S.

Here is all you need to learn about how to compute operating income using the traditional costing system Please answer question E4-3 and E4-8 vity-Based Costing Instructions For each product line compute operating income using the traditional costing system. Products Sales Revenue Traditional ABC Product 540X 198200 54440 45520 Product 137Y 158700 49090 39290 Product 249S 83190 11290 30010 Instructions a For each product line compute operating income using the traditional costing. In this case the unit cost for a hollow center ball is 052 and the unit cost for a solid center ball is 044. Contribution margin ine statement accounting for management causes of difference in operating ine under variable and absorption costing accounting for management how do operating ine and revenue differ the traditional ine statement absorption costing ine statement format examples accounting in focus genevieve wood i picked this diagram because of the side side view of the contribution ma contribution margin ine statement similarities and differences pare and contrast variable and absorption costing principles of accounting volume 2 managerial accounting For each product line compute operating income using the activity-based costing system.

Comments

Post a Comment